Evaluate Adviser Regulatory Filings

View into the quality of an Adviser's Form ADV, Form D & Form 13F

ORDERING YOUR REGULATORY REPORT CARD IS SIMPLE AS 1-2-3

Step 1:

Select Your Adviser

Step 2:

Select the Desired Adviser From Below

| CRD | Legal Name | DBA NAME | MANAGER NAME |

|---|

| CRD | Legal Name | DBA NAME | MANAGER NAME |

|---|

$750

ADD TO CART

As soon as your payment has been verified,

you’ll receive an email within 24 hours.

The SEC is Watching!

The SEC has publicly disclosed their use of more advanced data mining and analytical techniques to proactively identify Advisers that demonstrate "off-market" regulatory filing practices.

We spent several years evaluating, normalizing and curating data sources, including regulatory filings, to our accuracy standards and we developed various approaches to attribute fund assets to the respective Auditors.

Request a Sample

See how out data and research will optimize your business model. Contact George Gainer to set up a demo data today!

Note: your details are kept strictly confidential as per our privacy policy.

What is the Regulatory Report Card

Convergence's Integrated Compliance Report Card gives users a view into the quality of an adviser's Form ADV, Form D, and Form 13F filings and perhaps a glimpse into compliance stress.

"The Convergence team and their ADV Analyzer exceeded our expectations. They are experts on the Form ADV. Their guidance on completing our Form ADV and ability to describe market best practices was very helpful since we are a Non-US Adviser. We highly recommend Convergence's ADV Analyzer!"

-Compliance Manager at a Brazilian-based asset manager

"I use the ADV Analyzer in all of my pre- and post-investment due diligence. It helps me to identify compliance risk and assess the compliance culture at an asset manager."

-Operational Due Diligence professional at a state pension plan

"The ADV Analyzer is a necessary value-add tool that we include in all of our compliance products."

-Compliance Professional at a Top 25 fund administrator

"I don't know why every Chief Compliance Officer in this industry doesn't buy this."

-Current CCO at a $25 billion asset manager and former SEC Examiner.

FAQ

The ADV Analyzer measures the Total Quality of a Registered Investment Adviser’s (RIA) Form ADV filing.

The Total Quality Score is based on the Accuracy, Consistency and Frequency of the Registered Investment Adviser’s (RIA’s) Form ADV filing behavior.

The SEC continues to criticize registered Registered Investment Advisers (RIA) for inaccurate, inconsistent, and less frequent regulatory filings. The SEC has publicly disclosed their use of more advanced data mining and analytical techniques to proactively identify Advisers that demonstrate “off-market” regulatory filing practices. "Off-market” practices are relatively easy to spot when one examines the filing practices of one Adviser versus 17,000 other Advisers. Adviser filings across multiple periods that “materially” differ from their prior filings or are inconsistent with the filing practices of other Advisers across the market. Advisers with “off-market” practices are fertile ground for further inspection. The SEC views. Advisers making “off-market” filings as potential “bad actors” that can create risk to investors and the market.

Convergence measures Accuracy by examining your Form ADV filings for Errors and Omissions.

Convergence measures Consistency by examining your interim and annual Form ADV filings and when you updated them, were they consistent or inconsistent with the market.

Convergence measures Frequency by identifying the number of interim and annual Form ADV filings that you made during the year. Too many filings suggests the correction of errors and omissions and/or significant and material changes to your business, each of which is likely to draw the SEC’s attention. Too few filings suggests that your business has not changed materially enough to have filed an interim update. Period-to-period comparisons of changes can determine whether you make interim updates.

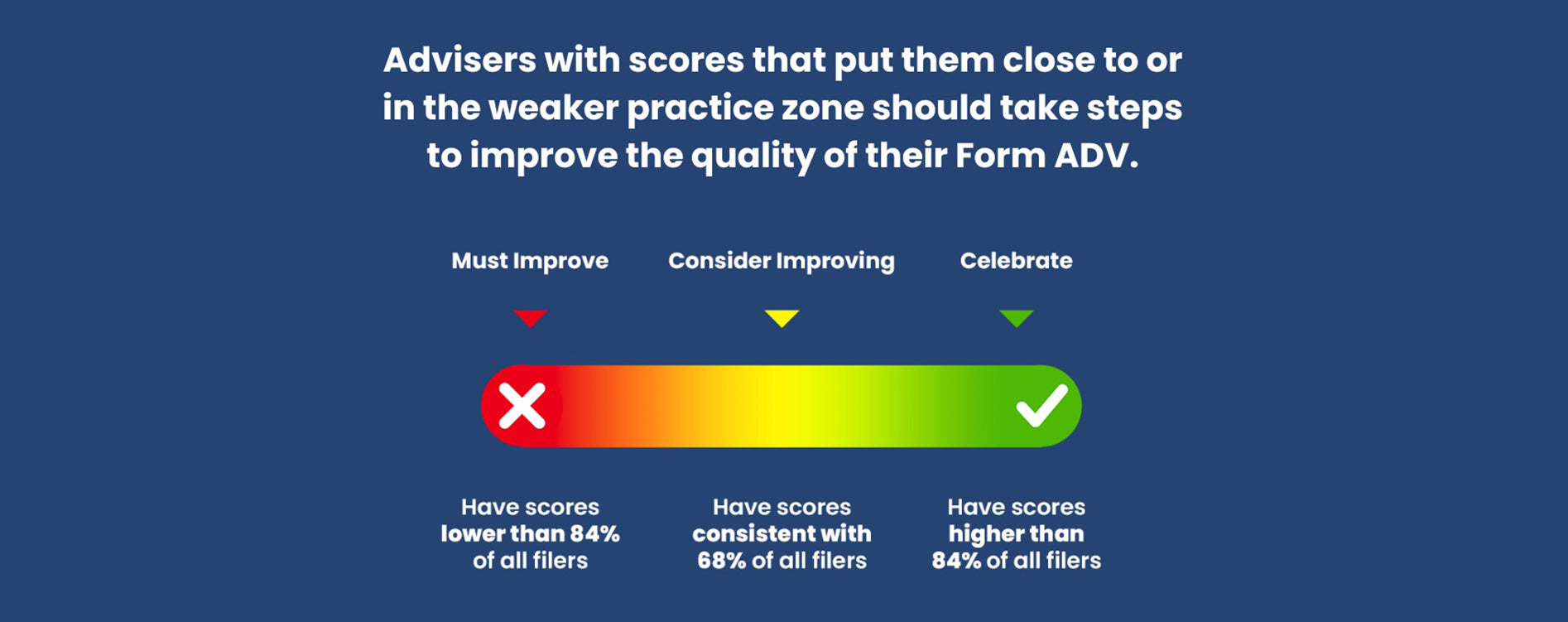

Convergence plots the Total Quality Score for all Registered Investment Advisers (RIA) in a distribution curve. Advisers in the “right tail” are considered Best Practices because their scores are higher than 84% of all filers. Advisers are considered to have “Consistent Practices” when they are in the “middle of the curve” and are consistent with 68% of all Advisers. Advisers in the “left tail” are considered to have Weaker Practices because their scores are lower than 84% of all filers. Advisers with scores in the left tail of their peer group distribution, and/or have individual test results in the left tail are likely to draw the attention of regulators.

The SEC and Investors expect Registered Investment Advisers (RIA) to issue accurate, consistent and timely regulatory filings. Advisers can demonstrate their commitment to regulatory compliance by meeting basic filing standards. Most Advisers seek to meet their basic filing standards. Yet, they don’t know how consistent they are to their peers. Investors, Regulators and Plaintiff Attorneys use “off market” filing quality for different reasons.The Contact Directory is available for download immediately after the order is complete.

- Improves the "quality" of your interim and annual ADV filings.

- Keeps you aware of the practices of all other Advisers in the market.

- Demonstrates your commitment to a strong "compliance culture."

- Avoids inadvertently tripping exam "triggers" used by the SEC.

- Reduces the cost and time created by excessive filings.

- Encourages "teamwork" across your organization to improve your regulatory filings.

You will receive the ADV Analyzer in PDF format.

You will receive the ADV Analyzer within 2 business days after purchase.

Yes – email detzbach@convergenceinc.com to learn more about purchasing multiple ADV Analyzers.

Yes, email your questions to rfqinfo@convergenceinc.com.

Have customized needs?

Get in touch with George Gainer: